In the real estate market, the build-to-rent (BTR) sector emerges as one of the major winners of 2023. BTR involves longer tenancy agreements managed by operators, financial groups, and developers that prioritize long-term viability, distinctive amenities, and a strong sense of community integration.

As tenants yearn for a lifestyle that transcends the ordinary, Crystal Lagoons delivers precisely that – an amenity featuring beach life, water sports, event esplanades, amphitheaters, and clubhouses that transform every day into a magical vacation-like experience.

This boom is evidenced by a new trend in the tenant profile, as tenants now prefer single-family rental homes and communities instead of buying. This shift in the market structure has made tenants less sensitive to rental prices, as potential homeowners are taking their chances and firmly believe that the Federal Reserve’s interest rates at 5.25% and home prices should go down in the near future creating new opportunities for purchasing houses at a discounted rate. The market last saw these rates in July 2006, when the US GDP was 3.2% and inflation 4.4%.

What does this mean for the market and developers targeting that specific segment?

Renters, by choice, are demanding superior quality homes. Studies have shown they highly value interior finishes, better amenities, and connectivity. As a result of these new demands in the shifting market, firms that meet the new standard can attain higher cash flows. And it has been seen on most of the projects with a crystalline lagoon with Crystal Lagoons technology on it, where sales have improved over a year (Sunterra sold nearly 800 units last year, being among the highest-selling communities in the country) and occupancy rates are at their highest.

Higher rates have affected the whole real estate market in terms of financing and development; this is because total existing home sales fell 2.4% from February to March and are also down 22% compared to last year, scaring investors off. If we compare the first two months of home purchases in the SFR firms segment between 2022 and 2023, purchases have fallen by 90% in 2023.

Despite this, larger-single family rental (SFR) firms are better off due to the positive impact on their balance sheets with increasing rent, and we must consider that single-family housing inventory is at its lowest point in the last 40 years. Larger investors are closely eyeballing these firms and can help projects with broader financing options for their specific needs.

Due to the current market condition, many analysts say that this will be the year of operational efficiency, not just efficiency when it comes to maintaining the property but specifically in the project as a whole, highlighting the use of technology in common spaces such as lagoons, concierge/reception, events, golf courses, and underutilized land. Incorporating technology that makes these projects more cost-efficient will be highly valued by investors because they are the same points set aside by developers and can improve earnings and drive sustainable growth in the long run.¯

The Way South

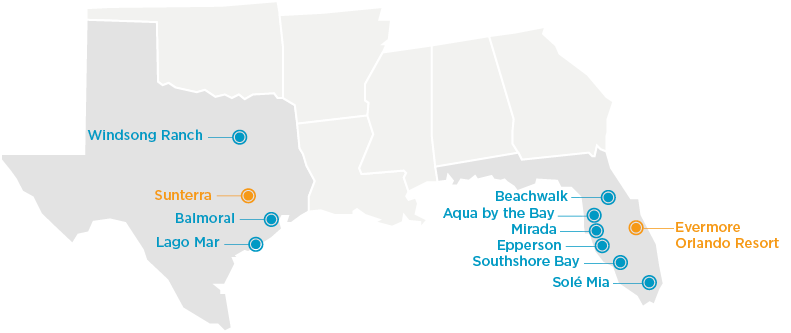

Investors are increasingly interested in the Sun Belt, a region spanning the Southeast and Southwest of the United States, comprising 18 states and 75% of the country’s population growth. Dallas and Tampa rank among the top ten US cities with the most real estate potential, where notably Crystal Lagoons has nine operational projects, several among the top-selling in the nation. While single-family developments remain important, multifamily communities are emerging as a major driving force in this region.

Traditionally attracting older couples for retirement, the Sub Belt has now become a sought-after destination for millennials due to its lower taxes and more affordable housing options. This demographic’s preference for suburban areas is fueling a substantial pace of suburban growth, with Generation Z expected to further contribute to this trend.

Adding an artificial lagoon powered by Crystal Lagoons® technology adds substantial value to existing and future developments in the area, leading to increased occupancy rates and higher rental prices. A crystalline lagoon is an amenity that holds greater appeal and interest for the discerning new generation of renters. Moreover, it serves as a low-cost development and maintenance project, generating added value for the community. Notably, a crystalline lagoon consumes only 2% of the energy and 100 fewer chemicals compared to a typical swimming pool of the same size.

Do you want to grow your business with the Crystal Lagoons® technology?